LakeBTC Trading Volume: Assessing Market Liquidity

LakeBTC Trading Volume: Assessing Market Liquidity

What is Market Liquidity?

Market liquidity refers to the ease with which an asset, such as cryptocurrency, can be bought or sold in the market without causing a significant change in its price. It indicates the depth and efficiency of the market, allowing traders to execute orders quickly and at a fair price.

Why is Market Liquidity Important?

Market liquidity plays a crucial role in any trading environment, as it directly impacts the ability to buy or sell assets without affecting their prices. High liquidity implies a large number of buyers and sellers in the market, resulting in tight bid-ask spreads and minimal slippage.

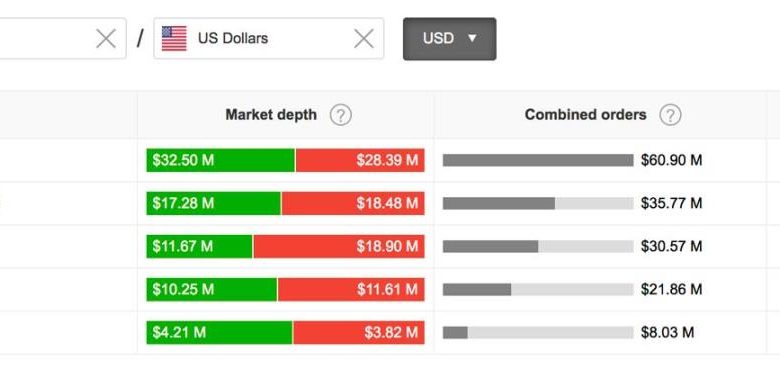

Assessing LakeBTC Market Liquidity

LakeBTC is one of the prominent cryptocurrency exchanges, and understanding its trading volume is crucial for assessing its market liquidity. Trading volume refers to the number of assets traded on the exchange within a specific period, such as 24 hours or one month.

By analyzing LakeBTC’s trading volume, traders can gauge the market activity and investor interest in specific cryptocurrencies available on the exchange. A higher trading volume generally indicates a liquid market, as it suggests a greater number of trades being executed.

Factors Influencing LakeBTC’s Trading Volume

Several factors can influence the trading volume on LakeBTC and other cryptocurrency exchanges. These factors include:

Market Trends

Market trends play a significant role in determining trading volume. During bullish trends, more traders tend to enter the market, driving up trading volume. Conversely, bearish trends may lead to lower trading volume as investors wait for more favorable conditions.

Volatility

Highly volatile markets often attract traders seeking to profit from price fluctuations. Increased volatility often leads to higher trading volume, as more traders actively participate in buying and selling assets.

New Listings and Partnerships

LakeBTC’s trading volume can be influenced by the addition of new cryptocurrencies or partnerships with other exchanges or platforms. These events often attract traders’ attention and increase trading volume.

Frequently Asked Questions (FAQs)

Q: Is high trading volume always a good thing?

A: While high trading volume is generally associated with liquidity and market interest, it is not always a good indicator on its own. It’s essential to consider other factors, such as stability, bid-ask spread, and overall market conditions, when assessing an exchange’s trading volume.

Q: How can I track LakeBTC’s trading volume?

A: Tracking trading volume on LakeBTC and other cryptocurrency exchanges is relatively easy. Most platforms provide real-time trading volume data that traders can access through their websites or API services. Additionally, third-party cryptocurrency data providers offer comprehensive market information, including trading volumes.

Q: Does LakeBTC’s trading volume guarantee liquidity?

A: While high trading volume suggests liquidity, it does not guarantee it. Other factors, such as order book depth, trading activity distribution, and the presence of market makers, also play a crucial role in determining market liquidity.

In conclusion, assessing market liquidity is crucial for traders looking to execute trades efficiently. Understanding LakeBTC’s trading volume and the factors influencing it can provide valuable insights into market activity and help in making informed trading decisions.

Remember, trading volume is just one aspect to consider when evaluating an exchange’s liquidity. It is essential to consider other factors, such as spread, stability, and overall market conditions, for a comprehensive assessment of the market liquidity on LakeBTC or any other cryptocurrency exchange.